The Best Strategy To Use For Kam Financial & Realty, Inc.

The Best Strategy To Use For Kam Financial & Realty, Inc.

Blog Article

The Best Guide To Kam Financial & Realty, Inc.

Table of ContentsThe Best Strategy To Use For Kam Financial & Realty, Inc.Little Known Facts About Kam Financial & Realty, Inc..Some Known Factual Statements About Kam Financial & Realty, Inc. The Kam Financial & Realty, Inc. DiariesThe 20-Second Trick For Kam Financial & Realty, Inc.4 Simple Techniques For Kam Financial & Realty, Inc.

A home mortgage is a funding used to acquire or keep a home, plot of land, or other actual estate.Home loan applications go through a strenuous underwriting process prior to they get to the closing phase. The building itself serves as security for the loan.

The cost of a home mortgage will certainly depend on the kind of financing, the term (such as 30 years), and the rates of interest that the loan provider fees. Home mortgage rates can vary widely depending upon the sort of product and the certifications of the applicant. Zoe Hansen/ Investopedia People and services make use of mortgages to get real estate without paying the entire acquisition rate upfront.

The Best Strategy To Use For Kam Financial & Realty, Inc.

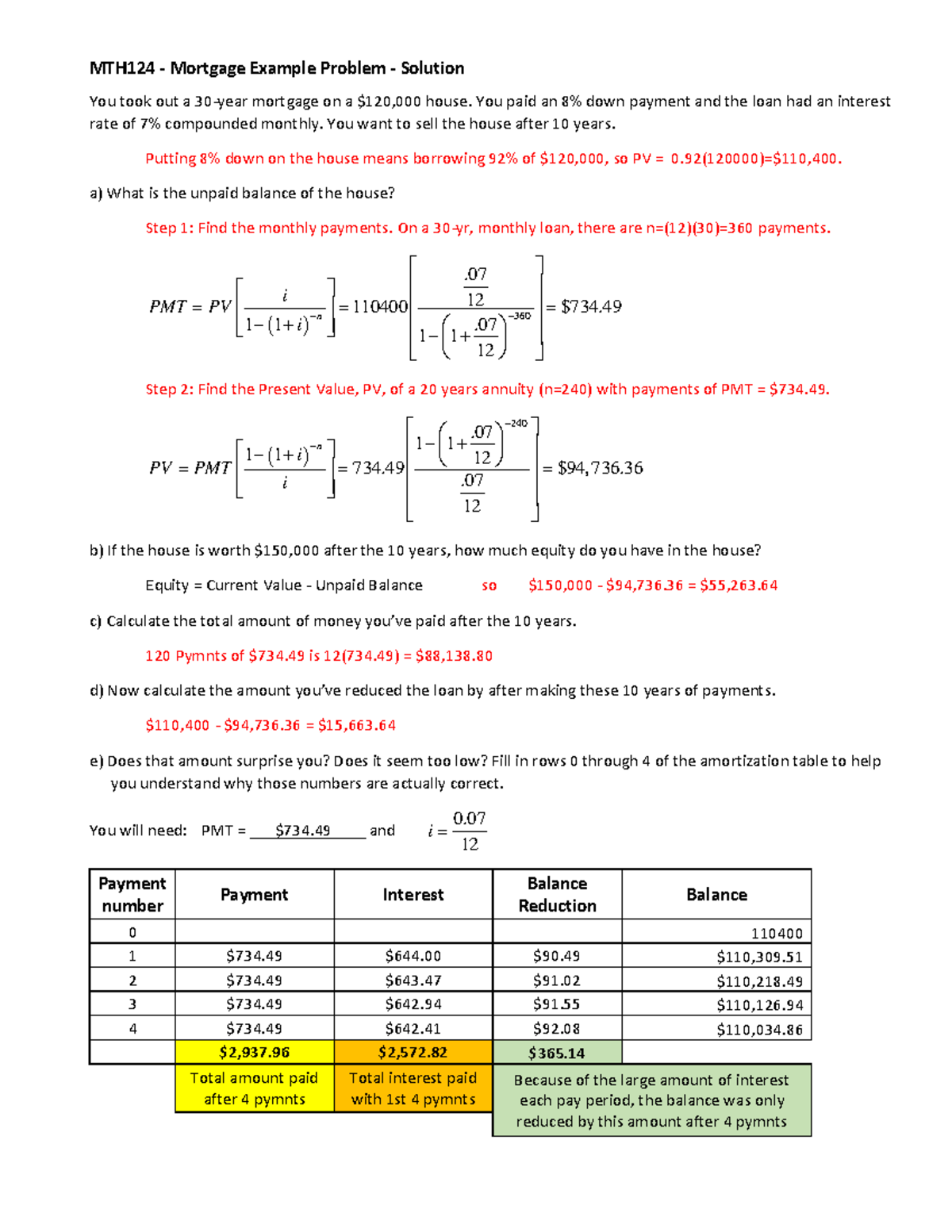

Most conventional home loans are totally amortized. This suggests that the normal settlement amount will certainly remain the exact same, however various percentages of primary vs. rate of interest will be paid over the life of the lending with each repayment. Regular mortgage terms are for 15 or 30 years. Home mortgages are likewise referred to as liens versus home or insurance claims on building.

For instance, a domestic homebuyer pledges their residence to their lender, which then has a claim on the residential or commercial property. This makes sure the lender's rate of interest in the home should the purchaser default on their financial responsibility. When it comes to foreclosure, the lending institution might force out the citizens, sell the residential property, and use the cash from the sale to settle the home loan financial obligation.

The loan provider will request evidence that the consumer is qualified of paying back the car loan. This might consist of bank and investment statements, recent tax returns, and evidence of present employment. The loan provider will generally run a credit report check too. If the application is approved, the loan provider will provide the debtor a funding of approximately a specific quantity and at a specific rates of interest.

The 8-Second Trick For Kam Financial & Realty, Inc.

Being pre-approved for a home loan can offer buyers an edge in a tight real estate market since vendors will certainly know that they have the cash to support their deal. As soon as a buyer and seller settle on the regards to their deal, they or their agents will certainly fulfill at what's called a closing.

The seller will transfer ownership of the residential or commercial property to the customer and get the agreed-upon sum of cash, and the customer will certainly sign any remaining home loan papers. The loan provider may charge fees for originating the financing (sometimes in the form of factors) at the closing. There are numerous options on where you can get a home loan.

Kam Financial & Realty, Inc. - An Overview

The typical kind of mortgage is fixed-rate. With a fixed-rate home mortgage, the passion rate stays the very same for the entire regard to the lending, as do the customer's monthly payments toward the home loan. A fixed-rate home loan is additionally called a standard mortgage. With an adjustable-rate home loan (ARM), the passion price is fixed for a preliminary term, after which it can change regularly based on dominating rate of interest.

Kam Financial & Realty, Inc. Things To Know Before You Get This

The whole lending balance becomes due when the borrower passes away, relocates away completely, or offers the home. Factors are essentially a cost that consumers pay up front to have a lower rate of interest rate over the life of their loan.

Our Kam Financial & Realty, Inc. PDFs

Just how much you'll need to spend for a home mortgage depends on the kind (such as dealt with or adjustable), its term (such as 20 or thirty years), any kind of price cut points paid, and the passion prices at the time. mortgage lenders california. Rate of interest can vary from week to week and from lender to loan provider, so it pays to search

If you default and foreclose on your home mortgage, nevertheless, the bank might end up being the brand-new proprietor of your home. The rate of a home is typically far more than the amount of cash that the majority of families save. As a result, home mortgages enable people and households to acquire a home by taking down only a relatively tiny deposit, such as 20% of the acquisition rate, and acquiring a funding for the balance.

Report this page